I'm fond of saying YeNom is the reverse of money. It is perhaps reasonable then to clarify some basics regarding the world's most popular money. Fortunately we have classic comments from Alan at our disposal to serve as authentic examples of popular legends. Reacting to my post “The thought provoking Eric Harris-Braum”, Alan argues, “... referring to [the] introduction of government money, you say, ‘… money is injected into the economic area via bank loans (so it is never free and always burdened with interest). Plus it trickles down from the money moguls to the producers.’ I believe you are looking at this with blinders on! Bank loans are in the middle of the cycle, not at the beginning. Banks can only lend money they possess. They do not create it. The government does that, lending initially created money to the banks to re-lend. Banks also re-lend money from deposits. These deposits come from both the moguls and the peons, meaning it both trickles down and up (i.e., it is again with blinders that you ignore an important part of the overall equation).”

To best deal with these typical assertions, I naturally turned to our friendly fiend the Internet. And while the majority of the results coughed up by an initial search are expected to be crude, this particular monetary topic was considerably comical. Government sources are particularly prone to avoid substance and gravel in trivia. Although many ‘authorities’ may welcome Alan's viewpoints and want to encourage them, I still could not find any instance where the line was crossed with blatant falsehoods to justify anything like Alan purports. Not even the Bureau of Engraving and Printing with the incredibly intriguing domain name of moneyfactory.gov offered any support for Alan's claims.

Yet despite a world of fluff, there is still mountains of hard clear documentation aligned with my position. A lucid booklet called MODERN MONEY MECHANICS – A Workbook on Bank Reserves and Deposit Expansion was originally produced and distributed free by the Federal Reserve Bank of Chicago. It is out of print now, but you can still get your own pdf copy at http://landru.i-link-2.net/monques/MMM.pdf or right here. The most on point section has to be the following:

Changes in the quantity of money may originate with actions of the Federal Reserve System (the central bank), depository institutions (principally commercial banks), or the public. The major control, however, rests with the central bank.

– The actual process of money creation takes place primarily in banks. As noted earlier, checkable liabilities of banks are money. These liabilities are customers' accounts. They increase when customers deposit currency and checks and when the proceeds of loans made by the banks are credited to borrowers' accounts.

– In the absence of legal reserve requirements, banks can build up deposits by increasing loans and investments so long as they keep enough currency on hand to redeem whatever amounts the holders of deposits want to convert into currency. This unique attribute of the banking business was discovered many centuries ago.

Section What Limits the Amount of Money Banks Can Create? then concludes with, “Thus, the legal reserve ratio together with the dollar amount of bank reserves are the factors that set the upper limit to money creation.” Where “money creation” again equates to crediting bank loans to borrowers' accounts.

Yet more dismal news is to be had directly from the Federal Reserve Board in their current pdf publication titled The Federal Reserve System – PURPOSES & FUNCTIONS as found at: http://www.federalreserve.gov/pf/pdf/pf_complete.pdf

This document maintains: “Although the issuance of paper money in this country dates back to 1690, the U.S. government did not issue paper currency with the intent that it circulate as money until 1861, when Congress approved the issuance of demand Treasury notes.” Hence the U.S. government wasn't even active in the paper money scene for the first 171 years of its circulation. And the government is now essentially on the sidelines yet again.

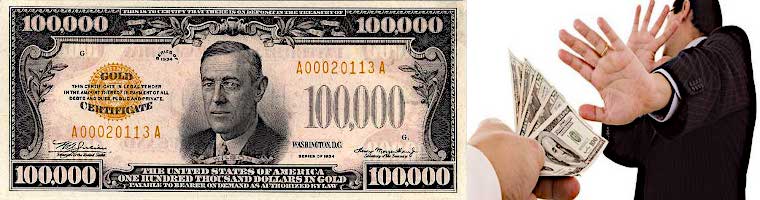

We further read, “All currency issued by the U.S. government since then remains legal tender, including silver certificates, which have a blue seal for the Department of the Treasury; United States notes, which have a red seal; and national bank notes, which have a brown seal. Today, nearly all currency in circulation is in the form of Federal Reserve notes, which were first issued in 1914 and have a green Treasury seal.” By George, Federal Reserve notes come with a green Treasury seal, they are additionally imprinted with the signature of both the “Treasurer of the United States” and the “Secretary of the Treasury”. Plus we must not forget the compelling images of the likes of Washington & Jefferson. President Washington was so much against fiat that he even used his own silver savings for the initial coins minted. Moreover, Thomas Jefferson in 1791 bemoaned, “I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a money aristocracy that has set the government at defiance. This issuing power should be taken from the banks and restored to the people to whom it properly belongs. If the American people ever allow private banks to control the issue of currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children will wake up homeless on the continent their fathers conquered. I hope we shall crush in its birth the aristocracy of the moneyed corporations which already dare to challenge our Government to a trial of strength and bid defiance to the laws of our country.”

The really ‘cute’ thing here (‘disgusting’ works equally well depending on your temperament) is although the worse fears of both Washington and Jefferson have been realized, their very countenance are proudly (or shamelessly) used to add legitimacy to the exact thing they so fervently fought against. Talk about raw gaul! (or is ‘genius’ more apt?) Either way, such knavery has to be of great service in testing the limits of what can be pulled over on the public — a common vicious practice.

To be more than fair, let's acknowledge that no members of the U.S. Treasury are on the Federal Reserve payroll, and furthermore the Fed has no authority to actual manufacture physical currency (neither notes nor coin). So both Alan and the Chicago Fed can say, “The U.S. Treasury, through its Bureau of the Mint and Bureau of Engraving and Printing, actually produces the nation's cash supply; the Fed Banks then distribute it to financial institutions.” (“cash” in lieu of “money” is key here)

{http://www.chicagofed.org/consumer_information/the_fed_our_central_bank.cfm}

Curiously, the sentences prior to the one just quoted state, “… the Fed sells and redeems U.S. government securities such as savings bonds and Treasury bills, notes and bonds. It also issues the nation's coin and paper currency.” While these two excerpts are from the exact same source, this is not as inconsistent as it may at first seem (i.e. printing & issuing are not the same thing). Letting the Bureau of Engraving and Printing (moneyfactory.gov) speak for itself, “In addition to U.S. currency, the BEP produces several other security documents such as portions of U.S. passports, materials for Homeland Security, military identification cards, and Immigration and Naturalization Certificates.”

{http://www.moneyfactory.gov/section.cfm/2}

So these dear folks are just the printers. They do NOT determine how much currency is printed anymore than they determine how many passports, IDs or I&M Certificates are created. It is solely the Fed (responding to bank demand) who determines how much physical currency is make and even exactly where the tokens are disposed. Like the portraits and signatures, the ‘participation’ of both the BEP and Treasury is mainly for show since the Fed is calling all the shots with zero Executive Branch intervention. Alas, to make Alan's position yet more dire it is well recognized that even given the BEP's contribution (however trite), “The amount of money printed has no relation to the growth of the monetary base (M0).”

{http://en.wikipedia.org/wiki/Federal_Reserve_System}

Moreover, even while the physical currency portion of the money supply has zero policy leverage (being 100% ‘tail’ in the wagging game) its relative quantity is small and yet more significantly it's shrinking with a vengeance. Heck, carrying very much of the stuff is almost a crime these days.

My point about money trickling down from the money moguls to the producers simply recognized that the bankers' system only grants the power of Federal Reserve money creation to themselves – by making (wise & prudent) loads to ‘deserving’ entities (the government with their flood of ‘securities’ represents the fountain head – i.e. the holly source of debt that drives the machine). Producers themselves are bared from direct participation and so depend on expanded economic activity from bank money to trickle down to them. Note: Selling stock –a money worthy asset– can admittedly be a powerful option for the producers who can accommodate the requirements.

Interest is a bigger deal than it initially appears due to 1) compounding, and 2) the “Multiple Expansion Process” which is much more immediate and potent (this is well covered in the materials cited). The interest game is broadly addictive and is the key means of holding money within the banking system. So even though keeping funds in the bank is a guaranteed looser, stashing cash in your mattress is notably worse.

Alan continues with more musings, “However, the government that originates the money is doing it for ‘free’ to the extent that they are expanding the money supply (as opposed to taxing, which is a far worse burden than is loan interest!). The banks both pay and receive interest, but rather than the interest just being a burden, it is a regulator to prevent rapid inflation while simultaneously rewarding the banks for their productive role (the interest burden resulting in the bank's profits). I am not suggesting that an independent monetary system, say, YeNoms, could not be made to work better free of interest sucking banks, but I am suggesting that the banks play a positive role in the government system currently in use by most the world (even in Islamic countries where ‘interest’ is earned in ways that avoid the direct imposition of interest).”

The truly huge part played by the government in this scheme lies in its precious ‘securities’ (the preferred sexy euphemism for ‘debt’). Beyond this critical component, government has little involvement in this monopoly. Thus the first part of the above paragraph effectively finds increased U.S. government debt less burdensome than taxes. To argue that expanding the money supply is (by any measure) a ‘free’ solution is consequently quite curious. Admittedly the Fed can drastically expand (or contract) the money supply through manipulation of the reserve requirements and other means to a lesser extent (such as interest rates). However, none of these measures decisively enable the government to directly usurp producer's assets to fund its objectives. Whereas increases of government debt (deficit spending) unerringly achieves this wealth transfer (although more stealthily).

Tree big differences between overt taxes and deficit spending are:

1) The thief of taxation is blunt and obvious (often involving arduous self-incrimination and invasive reporting requirements). Compliance is always encouraged (some may say compelled) via coercive threats.

2) Deficit spending of $X billion not only directly advances government objectives at the expense of those using bank money, but additionally kicks in a handsome interest penalty to the advantage of the Fed. Whereas the damage from taxation is held at the $X billion figure. This obviously ignores the even more insidious harm that usually flows from the actual implementation of government sponsored programs; but that's pretty much the same regardless of how the funding was pulled off.

3) Taxes afford the government far more power for precise reward & punishment social manipulation. Whereas the damage from deficit spending lacks planed discrimination. Nevertheless it certainly hits the hardest on those who lack the education or means to protect themselves from its onerous effects.

— Alan's sentiment that taxes are a worse burden than the loan interest (on deficit spending), is (strictly speaking) easily true in the short run. However, this astonishingly & wholly ignores the significance of the principle/debt on which the interest is being paid! Nevertheless let's re-look at the above three considerations with costs in mind.

1) In terms of laborious overt taxes – there is no labor savings achieved by deficit spending; as the (paper) work is already expended anyway when paying the normal taxes. In other words, the deficit could have been avoided simply through a mere rate hike with no extra filing hassles. Higher rates of course cause the over taxed individual to suffer a stiffer psychological insult. Depending on your values, those favoring awareness of the people would find deficit spending costly in this regard. While those enamored with aiding & abetting the state would find upfront taxes too risky.

2) Make no mistake about it — deficit spending is a tax (albeit yet more dishonorable than most). And despite the higher overall dollar cost of deficit spending, persons committed to expanding the control and influence of the Fed will prefer deficit spending to higher on-record taxes.

3) Finally, when it comes to the targeted social manipulation enjoyed by precisely engineered tax legislation — the crux to cost assessment is determined by the faith one has in the wisdom of social planners to prescribe a course of action superior to what the subject would elect on their own.

— From my perspective, deficit spending is more costly in regard to considerations 1 & 2, while the 3rd notion of kind & good hearted socialist devising tax incentive based guidance is plain scary – something a would be sane society cannot afford. Those embracing interest on a growing debt over tax burdens are logically expected to always favor deficit spending.

Alan concludes with, “My last point is that the bank burden is a burden only to the extent that you ignore the concurrent benefits. (Note that this point is with reference to government fiat money, which is in context with your point.) One of the primary benefits is the minimization of the need for the ‘free’ money injection by the government. The loan cycle expands the money supply, reducing the overall control by the government (except they still hold most of the reins by controlling the wholesale interest rates). Take away the banks (i.e., loans), and you are left totally dependent on the government for money supply control. Take away the interest burden of loans, and you will have out of control inflation.”

In needing to say that the government still holds most of the reins by controlling the wholesale interest rates, Alan is –we hope– referring to the Federal Reserve Board of Governors.

“The Board of Governors is the federal government agency that regulates banks, contributes to the nation's monetary policy and oversees the activities of Reserve banks.

– The core of the Federal Reserve System is the Board of Governors, or Federal Reserve Board. The Board of Governors, located in Washington, D.C., is a federal government agency that is the Fed's centralized component. The Board consists of seven members –called governors– who are appointed by the president of the United States and confirmed by the Senate. These governors guide the Federal Reserve's policy actions.”

Nevertheless, “Each of the Fed's three parts –the Board of Governors, the regional Reserve banks and the Federal Open Market Committee– operates independently of the federal government to carry out the Fed's core responsibilities.”

{http://www.stlouisfed.org/publications/pleng/PDF/PlainEnglish.pdf}

Said independence extends right through to their all important funding which (unlike real federal agencies) is out of the hands of congress.

The essential difference between the Federal Reserve Act and the Aldrich-Vreeland Act lies in the flavor of the name and instilling that same flavor into the bill enough to adequately protect if from the Jeffersonian reactions that derailed their first attempt. World banking interest have proven to best prevail when -camouflaged as- or -confused with- or -linked to- government agencies. The Fed traditionally seeks to associate itself with the U.S. Treasury (which actually is a full fledged U.S. government agency). The Treasury is not a bank. Indeed, U.S. Treasurer, Alexander Hamilton (1757-1804) introduced plans for the First Bank of the United States. It was established in 1791 as the financial agent of the Treasury Department. The bank served as a depository for public funds and assisted the government in its financial transactions. Again from the St. Louis Fed's PlainEnglish.pdf we quote the following:

“In addition to serving as the bankers' bank, the Federal Reserve System acts as banker for the U.S. government. Federal Reserve banks maintain accounts for the U.S. Treasury; process government checks, postal money orders and U.S. savings bonds; and collect federal tax deposits. Certain Reserve banks also sell new Treasury securities, service outstanding issues and redeem maturing issues.”

So what is left to the U.S. Treasury Department? Well among other joys and a fancy source of signatures, they still remain in firm undisputed command of all currency issued with the blue seal for the Department of the Treasury — yes, that's right, Silver Certificates — impressive no? Naturally both the Secretary of the Treasury and the Comptroller of the Currency were made part of the Federal Reserve Board of Governors. That lasted 6 terms (some 23 years) until February 1, 1936 when their participation was no longer deemed appropriate.

If Alan considers the Fed Board of Governors as part of the government he is subject to, then I wonder if he also looks to them to represent his best interest. In any event Alan has clearly aligned his monetary reasoning along Fed lines so well, that his positions could hardly befit their cause more. Although increasing interest rates can slow down the velocity of money; a fundamental fallout of the whole compound interest paradigm is the requirement for an ever increasing money supply (a rumored ingredient to inflation). Actually however, lowering interest rates will indeed increase the growth of total interest due whenever if it triggers a sufficiently large increase in new loan creation (damned either way – ya gotta love it!).

From Alan's lead-in, “… the bank burden is a burden only to the extent that you ignore the concurrent benefits.” !?!?! Sir, PLEASE! Regarding money per se, I'm patently passionate about insisting that money is mankind's second greatest invention. And that applies to the entire history of money right up to how things currently stand with Alan's “government fiat money.” Suggesting that I'm ignoring benefits (concurrent or otherwise) is rather whimsical. If there is anything distinguishing in my monetary perspective it lies 180° away from ignoring its utility. How would you succinctly characterize your base evaluation of money?.

The proprietary world monetary system is huge. Nevertheless, the full potential of money is hideously hamstrung and is not performing anywhere close to it's potential which needs a fully free (open) system such as SUYO to be realized.

In closing, I'd sincerely like to invite anyone to kindly forward me any materials that support Alan's version of how the Fed monetary system works. Of all the references supplied above, the one most endowed with quality links to other resources is:

http://en.wikipedia.org/wiki/Federal_Reserve_System

The following table is further offered:

Organization WEB address and Phone number Board of Governors....... www.federalreserve.gov ... 202-452-3000 FED Bank Atlanta ............ www.frbatlanta.org ... 404-498-8500 FED Bank Boston ................ www.bos.frb.org ... 617-973-3000 FED Bank Chicago............. www.chicagofed.org ... 312-322-5322 FED Bank Cleveland ........ www.clevelandfed.org ... 216-579-2000 FED Bank Dallas .............. www.dallasfed.org ... 214-922-6000 FED Bank Kansas City ..... www.kansascityfed.org ... 816-881-2000 FED Bank Minneapolis .... www.minneapolisfed.org ... 612-204-5000 FED Bank New York ........... www.newyorkfed.org ... 212-720-5000 FED Bank Philadelphia .. www.philadelphiafed.org ... 215-574-6000 FED Bank Richmond .......... www.richmondfed.org ... 804-697-8000 FED Bank San Francisco ........... www.frbsf.org ... 415-974-2000 FED Bank St. Louis .......... www.stlouisfed.org ... 314-444-8444

Can anyone guess the simple reason why only one of the above domain names end with .gov?

Comments: