Subject: Bitcoin = YeNom perverted

Predawn Friday Jan. 20, 2006: Blog dedicated to a simple undeniable yank-proof ownership paradigm (‘SUYO’) is launched per an open letter to Richard Stallman. Based upon an abiding human impulse for gift giving, SUYO aims to honor this innate tradition and catapult it to a solid foundation for individual enrichment by rigorously securing gifted ownership. This being accomplish with an open database of historically chained owners via PGP public/private key signings. The vehicle of implementation (the gift) was originally named ‘GNU.hope’ until re-branded as ‘YeNom’.

Three years later: Bitcoin makes the scene relying on the exact same plan of an open database consisting of public/private key chained items. However, said items -in direct contrast to YeNoms- were decisively not about any unique property possession. Instead they were blocks of sundry transactions endowed with ‘inputs and outputs’ of largely undefinable bitcoins.

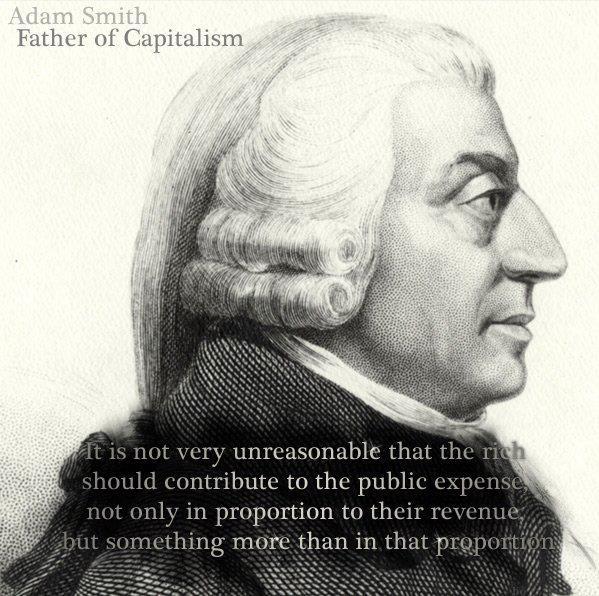

For those respecting Mr. James Rickard, the same succinctly scribes, “... he was practical enough to realize that currencies must be anchored to something ...” Where "he" is none other than J.M. Keynes! In consideration of this proviso:

A: “... the Yuan dynasty, formed by Kublai Khan in 1271 is credited with sending many of China’s innovations to the Western world via Marco Polo.” The most monstrously magnificent being paper money — all the tea & titillating tangibles not withstanding. Uncovering how this tactic was employed to funnel a majority of real wealth/power to the dynasty would certainly not be overlooked by any upcoming self-respecting western elitists. And this currency's ‘anchor’, where is it?? The inconvenience of death if not readily accepted? {also: “When Marco Polo saw the paper currency for the first time” and “The Invention of Paper Money”}

B: “You shall not crucify mankind upon a cross of gold!” Happily, this addressed a real debate concerning the right anchor -silver or gold or both- for US currency. Prominent among those found in the gold only camp, is the same element who's agenda was triumphantly realized on December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law. Yet they inherited silver certificates (dating back to 1878) which took fifty years to completely dispense with.

C: “Nowadays in the United States, base money takes the physical form of coins (tokens issued by the United States Mint under authority of Congress) and notes (which used to be circulating claims on the Federal Reserve but are now in the nature of paper tokens)...” so confirms François R. Velde, senior economist for the Chicago Fed Letter in his essay Bitcoin: A primer. Velde candidly continues, “Bitcoin is a fiduciary currency / Fiduciary currencies—in contrast with commodity-based currencies (such as gold coins or bank notes redeemable in gold)—have no intrinsic value, and derive their value in exchange either from government fiat or from the belief that they may be accepted by someone else. They are inherently fragile; government orders can be ignored or doubted, and a currency that has value only because of the belief that it will have value may have no value at all (for instance, if I believe that no one will accept it, I will not accept it either).” Well, we can't fault the man for not being forthcoming! {like myself, he also promotes the parenthetical}

If it appears that again there ain't no anchor to be found that's debatable; for at base the FED is forever merrily monetizing US debt. While that's always seemed like a flawed formula; insult is also lavishly added with the images used to endow FED notes with an inferred endorsement. Dollar notes feature Washington who admonished, “There is no practice more dangerous than that of borrowing money.” Disgracefully commandeering the likeness of valiant men to advance the very treachery their lives opposed is deplorably in keeping with Orwellian ways. The use of Lempira on Honduran currency underscores a fondness for inexcusable insults & lies to manipulate consent for duplicitous agendas. So again, where's the regard for an anchor? Particularly when nothing could be more evident than the FED's menacing march to be free of any anchor of any sort. Getting rid of both gold & silver is hardly enough — even paper and the process of printing cash is (like our Constitution) too restricting - got to go digital - less cost - easier to track - et cetera; until they're ultimately wielding quantitative easing.

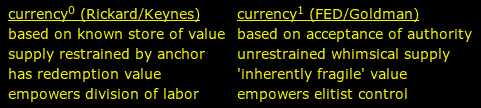

Looks like the above is mostly making a muddled mess of a currency's anchor prerequisite. Further, Keynes' ‘anchored to’ was intended to mean ‘backed by’ yet I've smeared it to include restrictions in general (not to mention too many tangents). My excuse/motive is to vividly lay bare the reality that one's currency preferences are necessarily defined in accordance with their agenda(s). To wit:

An obvious follow-on argument is: OK -fine- how does all this relate to bitcoin? Isn't it open (source) and hence the opposite of a closed FED system? No. Such a perspective is so blinded by a relatively trite technicality that it can not see the undeniable accord shared by the two fiduciary currencies at a fundamental level. Even the supposedly glaring difference in the fixed supply of 21 million bitcoins verses the rather endless supply of dollars is a totally perverse deception.

Per bitcoin philosophy/logic/BS we must concern ourselves with scarcity; it's a prerequisite to value and used to justify ‘proof of work’ (as an imagined means to effect scarcity) and excuse the worth of gold. Andrei Dinu weighs in heavy on this in his paper The Scarcity of Money : The Case of Cryptocurrencies which advises, “The main purpose of the present research is to determine whether cryptocurrencies are scarce and can, by this virtue, be regarded as money.” So bitcoin purportedly enjoys blessed scarcity (and work ethic) to give it substance.

Well, considering that (per the FED itself) Federal Reserve Notes ($s) “are now in the nature of paper tokens”; they nevertheless enjoy an underpinning morally superior to bitcoin. I mean despite the fact that the value of electronic dollars far exceeds physical cash, one can still (tentatively) exchanged/redeemed them for pretty paper bills. So dollars have some catching up to do before they achieve bitcoin's levels of abstraction. Yet more pertinent, lets imagine a currency anchored/backed to air or water (which ever seems most worthlessly abundant {scarcity deficient} to you). It would still be way more moral than bitcoin. Why? Because bitcoin (unlike the thin air we breath) has zero mass (one of an anchor's expected features). If that sounds silly or pretentious then perchance mere reactions are supplanting rightful thinking. The point is -if molecular theory is valid- then there is a limit to how finely any material can be divided (until it ceases to be). Bitcoin is not restricted by any such limitation. What this means is that a programmed limit of 21 million while a damn serious concern in certain circles is still ultimately & absolutely meaningless. It might as well be 1 which is equally divisible (by virtue of negative superscripts) as a duoquinquagintillion. Ellery Davies also addresses this here.

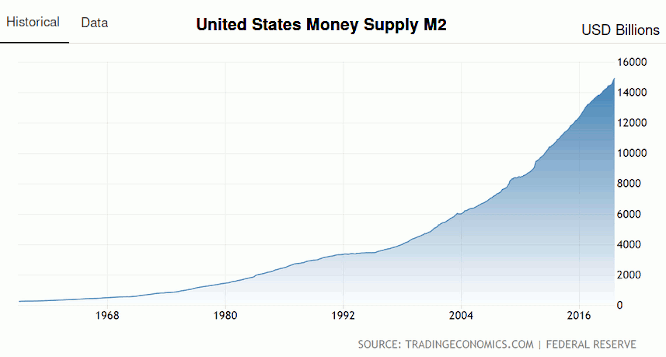

Thus we have: FED notes which as of WWII have seen an accelerating proliferation (M2 graph below), and bitcoins with the ready potential for infinite division (via forks easily agreed upon and trivial to implement). While inflation & deflation are opposites by definition, it's a red herring because that minor issue pales in comparison to the fiduciary nature both currencies share. This in turn engulfs them into a zero-sum game which essentially means that winners gain at the losers' expense. Moreover, as the 1930s showed, the FED certainly has a propensity for active deflation when it suits them. And given the miserable losses suffered in the Great Depression it is assured that commiserate gains -at an atrocious losers to winners ratio- were also fully realized (although not so widely celebrated). In any event, those in control of inflation/deflation will be positioned to gain equally well either way (the same can be said of positive & negative interest rates). The only difference lies in who is being had. Inflation takes from those innocent enough to be overly tied to FED tokens — on the other side of the coin, upward valuations of bitcoin massively benefit head honchos sitting on over a million of these babies. Note: it would be remiss not to mention that zero-sum games can have decisively positive effects, but that discussion is not for now.

In addition to the above anchoring issue, this bitcoin business merits yet more rumination:

1) Bitcoin has exposed itself in a way that the US has traditionally acted decisively and always successfully to annihilate. Naturally politicos seeking attention will willy-nilly attack bitcoin yet the sanction persists. The question is WHY?

2) Bitcoin is heralded to be pseudonymous. Yea, well if you think the NSA is incapable of identifying & tracking the major players ... then more power to you!. Blockchain — A Wolf In Sheep's Clothing? The BIS does not envision CBDCs impacting “Monetary policy aspects”; while the stand alone Federal Reserve Gov. Lael Brainard writes “Executing monetary policy in such a manner would effectively imply the elimination of all physical cash and the power to impose a negative rate, or a tax, on households’ holdings of digital money.” — October 16, 2019

To think that bitcoin provides a solid foundation for privacy was laughable even before Henri de Castries' Blockstream involvement.

3) Contemplating bitcoin's stellar price appreciation: While tulip bulb mania and the dot-com bubble may set notable reference points for crowd craziness - can these same human weaknesses honestly account for bitcoin excesses, or is it receiving some covert help/stimuli? Is bitcoin an impotent weenie that can't stand on its own but given tacit support since it points in the direction the status quo wants to go?

4) It is hard to imagine anything (outside of another drastic 911 type event) that would better further an authoritarian agenda than some monumental & catastrophic downfall of bitcoin. [ higher the rise = greater the fall ] So massive increases in bitcoin plays directly into the hands of the big boys. After the smoke clears (or thickens?) -sitting in center stage- will be their own unveiled cryptocurrency buttressed by coercion (a.k.a. fiat).

5) Bitcoin decentralization is glorified within its BOX as a technological savior. But its developers, detractors and governance are also key issues — tech decentralization per se can hardly prevail against insiders, miners, power clicks, or benevolent dictators that turn against the community intentionally or not. Blockchain: gatekeeper or liberator?

In monetary terms, how do bitcoin & YeNom compare? Well the powers to be expect money to serve multiple purposes. The minimum cited job set is three, four issues are the norm, with six functions also mentioned. Let's focus on the main three - namely: 1) a medium of exchange, 2) a store of value, 3) a unit of account. While the importance of these attributes varies among advisers, ‘a medium of exchange’ is usually cited as #1. So per this perspective (even though YeNom ownership can be transferred) bitcoin prevails hands down! Moreover, YeNoms totally fail as a unit of account (as every YeNom is unique). So despite how bad the wildly fluctuating bitcoin is for this job, YeNom is worse. And as a store of value? Finally yes, depending on the YeNom, this can be accommodated extraordinarily well. Yet over all, perhaps YeNom shouldn't be consider a money at all (as it is the literal reverse of same). Let's investigate some considerations anyway:

1) US banking elite want their thing to fulfill every job ... what a crude stratagem. Serious audiophiles seek dedicated components to realize exacting requirements for an exceptional system. As the scope of global monetary needs evidently exceeds that of a sound system, dedicated solutions to handle diverse criteria is most definitely needed. However, when only ‘the dollar’ handles everything, its psychological dominance is better assured. Hence to maintain a monopoly, enhanced effectiveness via optimized tools per task is unacceptable.

More emphatically, assigning independent modules to manage distinct money related metrics is imperative as the power of modularity is a key to explaining the following: How is it conceivable that the world's largest, wealthiest, and thoroughly entrenched software company (M$) could possibly be wholly humbled by the financially powerless GNU/Linux & BSD ilk? The following arguments for modularity stand opposed not only to the dollar does everything thought prison, but even more so to failings in bitcoin design:

One factor is the ‘open source’ morality; which is admittedly embraced by bitcoin and crucial to both Apple{BSD} & Android{GNU/Linux} basing their OS on these free products. More germane, preeminence of the architecture is achieved by adopting the ruling tenant of UNIX — leverage adroitly designed robust modules for specific well defined tasks in an environment where they cooperatively execute for maximum flexibility. Approaching things via unduly monolithic -ever more complex- programs makes unplanned vulnerabilities an inevitability. Eric S. Raymond's work, “The Cathedral and the Bazaar” impressively details this whole phenomena; showing why anti-cathedral results (in terms of functionality & quality) are so dramatic. At every turn SUYO/YeNom seeks maximized integrity via minimized complexity and avoidance of ill conceived abstractions.

As the technology required to defend thief prone currencies evolves evermore complex, the more it is removed from the domain of the average user and put into the hands of a few specialist adept in the art (a new elite class). Even a two-year-old can genuinely esteem the significance of a gift, to adequately evaluate all the abstractions orbiting bitcoin, however, requires understanding the likes of Byzantine fault tolerance for starters. And while grokking the institution of gift-giving is the only thing needed to embrace the essence of SUYO, an acquaintance with public-key cryptography is clearly valuable. Actually, any modern educational curriculum lacking a fairly comprehensive goal for literacy in asymmetric key algorithms is -IMHO- guilty of moral negligence.

2) YeNom intentionally has no means & holds no hope of enriching any developer over anyone else. Bitcoin and the many currencies modeled after it are not ponzi schemes by definition. Albeit no machination yet devised could effect more gains, control, and power as that cornered by the bitcoin inner circle should it become the world's principle transaction engine (as events wax in this direction unexpected yet foredoomed infections fester). YES - Satoshi Nakamoto and crew need be credited for their innovative contributions to the cause. But does it trump the groundbreaking gains achieved by Philip R. Zimmermann? Not to mention the many magnificent minds behind the free & open software world. So herein lies the bitter black irony and vicious betrayal that is bitcoin. Because it is this exact same thing that constituted the impassioned motive for SUYO/YeNom — the insult, for example, of the insanely unjust wealth actualized by the atrocious tactics of M$ in crying contrast to the honor worthy “‘Prophetless’ Hackers”. I'd love to name names, but the inevitable holes in such a list would be unforgivable.

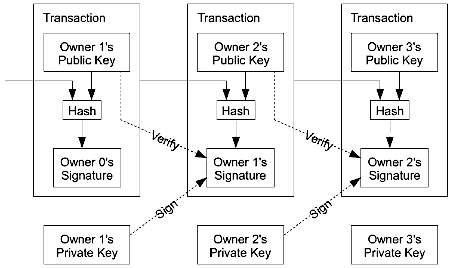

In conclusion, it matters not if our bitcoin gang are as innocent naive children or they're insidious coldly calculating unholy power hungry daemon-deacons or anything in between. Whether it's stuck in its tracks or raging wildly out of control, moving forward or backward or tundering down a cliff — bitcoin is simply the wrong frigging nihilistic {LīLī}TRAIN, incapable of taking us to any pretty promise land. 3) The YeNom chain v. the bitcoin chain: The second page of bitcoin.pdf perfectly outlines the YeNom chain as first introduced over three years earlier. The existence of this at the root of the entire bitcoin design certainly lends validation to my concept of a ownership chain via PGP digital signatures. Unhappily, the employment of this technique by bitcoin is grossly antithetical to ownership of anything unique much less conductive to individual empowerment. As seen in Satoshi's diagram on the left, the bitcoin chain is focused around a ‘Hash’, whereas YeNom, is all about the ‘comment’ (gist of a YeNom). And it is upon this very point, this fulcrum that a whole array of rubs revolve. YeNom's chain was carefully devised for the expressed purpose of gifting. Using same for transactions via a valueless digital token is at the heart of bitcoin's persistent problems, where moral issues directly spawn technical embarrassments. Such harsh words will be defended after first noting that this ‘Error begets more of the same’ theme is assuredly a fundamental and bitcoin is in no way a special case.

3) The YeNom chain v. the bitcoin chain: The second page of bitcoin.pdf perfectly outlines the YeNom chain as first introduced over three years earlier. The existence of this at the root of the entire bitcoin design certainly lends validation to my concept of a ownership chain via PGP digital signatures. Unhappily, the employment of this technique by bitcoin is grossly antithetical to ownership of anything unique much less conductive to individual empowerment. As seen in Satoshi's diagram on the left, the bitcoin chain is focused around a ‘Hash’, whereas YeNom, is all about the ‘comment’ (gist of a YeNom). And it is upon this very point, this fulcrum that a whole array of rubs revolve. YeNom's chain was carefully devised for the expressed purpose of gifting. Using same for transactions via a valueless digital token is at the heart of bitcoin's persistent problems, where moral issues directly spawn technical embarrassments. Such harsh words will be defended after first noting that this ‘Error begets more of the same’ theme is assuredly a fundamental and bitcoin is in no way a special case.

As we'll see, SUYO/YeNom -by plan- is inherently immune to the inevitable vulnerabilities of bitcoin which irrepressibly attracts attacks on its integrity. While innovative solutions like Merkle tree plus ‘Combining and Splitting Value’ are quite creative for tackling troublesome issues, others such as brutish ‘Proof-of-Work’ are patently obnoxious. But in any case dangerously exorbitant complexity is needlessly introduced when the system's foundation is inappropriate for the objectives at hand. Bitcoin's use of digital key signatures does not take adequate advantage PGP´s mean & clean anti-forgery capabilities, whereas it is maximized for SUYO/YeNom, and the more this impeccable foundation can be leveraged the better.

4) Any compromise of PGP security by either a barely imaginable mathematical insight or the mind bending potential of a god-like quantum computer would devastate the current underlying public/private key strategy that define both YeNoms & bitcoins. Congruent with the preceding paragraph, the ramifications of such a wonderfully exceptional event would impact bitcoin in ways that could not effect YeNom. True, SUYO/YeNom would be substantial inconvenienced (understatement intended), but bitcoin: manifest obliteration - a notable difference. YeNom trading would obviously need be halted and current ownership frozen. Bearing in mind YeNoms are essentially one-on-one gifts, the majority of them could simply be reissued under an advanced key format when available, but bitcoin's queer utilization of this technology would doom it hopelessly to instant & fatal devastation - the realization that what was nothing has returned home. The same difference holds equally pertinent for the daily possibility of lost or stolen secret keys (e-wallet).

5) We cannot talk about bitcoins, without attention paid to their ever present nemesis double spending. Again, this is a major unavoidable inherent jeopardy, due to the system's foundation resting on a misused design; one that is perfect for SUYO/YeNom but only portends perpetual problems for bitcoin. Creative individual labor invested in a YeNom achieves a positive entity that could be worthy of active evaluation and utilized in unbounded ways. Double spending only serves to demean the unique YeNom in question while discrediting it's owner - it has zero impact on any other YeNom. FED notes ($s) and bitcoins even more so, are neutered nil entities. You can use them to precariously save or buy/transact. But unlike YeNoms, to do anything truly inventive directly with bitcoin per se, the only option is to indulge the negative realms of thief. This is necessarily a magnitude more serious problem for bitcoin since all coins are created equal and sacredly ‘scarce’. Thus any thief (particularly involving block chain forks) could threaten the entire schema endangering every bitcoin. The crux to their solution? — ‘Proof-of-Work’ — Both YeNom & bitcoin welcome "work" but yet again for opposite reasons along with a fouled concept of work for bitcoins. Honest work, in the case of YeNoms, is most prevalent in the production of a quality gift/gesture for your receipient - where personal effort directly benefits all involved. While work for bitcoin is a negative impulse at every turn; from the repugnant need to thwart invited thief in the first place all the way down to a concocted work solution mandating shockingly shameful resource waste.

6) Plato would have either loved YeNom and hated bitcoin or visa-versa depending on the unlikelihood that he was actually a statist. The ‘New World Order’ and international banking elite crave fiduciary faith (the more blind the better) based currencies — it's the only game for globalist; with bitcoin in full compliance. Veritably elevating the spectacle to new heights, even to the extent of leaving behind the force of fiat — bitcoin deserves to be truly envied. It's like we're being tested for gullibility limits. Appropriately, images depicting bitcoin are fond of identifying with the FED and flags - etc. The strongest theme they share in common is aversion to any institution seeking to establish individual worth out-side of established/permitted criteria (a.k.a. ‘the BOX’). In terms of a threat to fiat, bitcoin is actually an ally with a cap pistol — YeNom a 357.

7) GWR verses peer-to-peer network and the longest proof-of-work chain: I could have just said ‘blockchain’ but wanted to avoid confusion with scores of other cryptos & maintain fidelity with Satoshi Nakamoto's founding document. Within bitcoin.pdf ‘chain’ is found 27 times and ‘block’ 67 but never adjacent to each other (so the text is taken directly out of the founding doc). Commencing with the comparison:

For the sake of decentralization, bitcoin relies on an extensive peer-to-peer network where all are collectively required to adhere to some arbitrary protocol for inter-node communication and validation of blocks. Which is in turn is theoretically enforced by majority rule. In antipathy stands GWR. To be clear, the advent of blockchain along with smart contracts & distributed ledgers - etc. are all heartily celebrated. The more thief inviting a paradigm the more a severely sophisticated solution is needed. Everything about SUYO/YeNom however, centers around a playing field where the individual is paramount. This in-turn directly amends how decentralization issues are confronted. Particulars inherent in SUYO/YeNom monetization are set out here.